Frequent Asked Questions

About DFVN

Investment Solutions

WHEN DO I RECEIVE CONFIRMATION OF TRANSACTION?

» Confirmation of investment after investing in DFVN Capital Appreciation Fund (DFVN-CAF)

After the Buy Order is matched, Investors will receive an investment confirmation email from DFVN within 3 working days from the Trading Date but no later than the next Trading Date.

» Monthly holding statement

Within 05 working days from the end of the month, DFVN will send email to investors the monthly holding statement.

TRANSACTION SERVICE FEES WHEN INVESTING IN DFVN-CAF?

|

|

(DFVN-CAF is suitable for long-term investors; short-term trading will not be effective. The regular repurchase will affect the profit target of investors as well as the Fund's profit. Redemption fee will be accounted into the DFVN-CAF Fund as an income of the Fund.) |

|

|

DOES DFVN-CAF HAVE COMMITMENT TO PROFIT?

» Under the provisions of Circular No. 99/2020/TT-BTC of the Ministry of Finance, which clearly states the Fund Management Companies: “No commitment, no guarantee of investment results except for the case of investing only in Products have a fixed income”.

» DFVN-CAF has a diversified portfolio of listed stocks with large market capitalization on the Vietnamese stock market and no profit commitment. DFVN-CAF is the right choice for investors wishing to seize investment opportunities in Vietnam's stock market and maximize long-term investment returns.

BENEFITS WHEN INVESTING IN DFVN-CAF?

With a professional investment management team, experienced in asset allocation, dynamic and quickly adapting to changes in Vietnam's stock market which has great potential for development, when investing in DFVN-CAF investors have the following benefits:

» Professional investment management

» Optimize profits and risks thanks to diversified portfolio

» High liquidity and flexibility

» Transparent information, protecting investor's rights

» Suitable for all financial possibilities

» Simple way to invest, saving time

WHERE IS THE PROFIT OF THE DFVN-CAF FROM?

DFVN-CAF's profits mainly come from the results of investing in securities listed on Vietnam's stock market. Sources of profit for DFVN-CAF include:

» Prices increasing of the Fund's holding shares

» Dividends of shares held by the Fund

» Interest rate of money deposit

LIQUIDITY WHEN INVESTING IN DFVN-CAF?

» Investing in DFVN-CAF Fund is an investment channel with high liquidity compared to other investment channels. Investors can withdraw part or all the investment easily and quickly by making redemption oder on Trading Days.

» DFVN-CAF will buy back all the fund units at the NAV price minus the redemption fee (if any) when investors want to sell fund units.

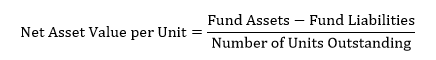

HOW TO CALCULATE THE NET ASSET VALUE PER UNIT (NAV/UNIT)?

TRANSPARENCY OF DFVN-CAF?

» Open-end funds are highly transparent financial products. The transparency of the DFVN-CAF is reflected by the close supervision of the State Securities Commission (SSC), the Board of Fund Representatives, the Supervisory Bank and annually audited by the Auditing Company. Information about the Net Asset Value and transactions related to the DFVN-CAF is regularly published on the websites of DFVN, SSC and Distributors.

» NAV/UNIT value is calculated by Supervisory Bank (HSBC) every valuation day. After that, DFVN will check and publish information on the company's website and report to the State Securities Commission weekly within 3 working days, after the latest trading day in accordance with the law.

WHEN SHOULD YOU INVEST IN DFVN-CAF AND HOW LONG YOU SHOULD INVEST?

» Investors should invest in the DFVN-CAF Fund as soon as possible as soon as they determine their personal financial goals. Financial goals can include: saving for retirement, buying a home, buying a car, starting a business or paying for a student's education abroad. The sooner investors make investments, the easier it will be to have opportunities to realize goals and take advantage of the power of compound interest.

» How long investors should invest in the DFVN-CAF completely depends on the financial goals of investors and the amount of periodic investment. DFVN-CAF is not a suitable product for short-term surfing. Investors should be patient, invest in long term, keep discipline and regularity by participating in the Systematic Investment Program (SIP).

HOW MUCH SHOULD YOU INVEST IN DFVN-CAF PER MONTH

» The amount of money investors should invest in the DFVN-CAF monthly depends on the financial objectives of the investor, the period that the investor needs to withdraw capital (investment period). Investors should invest with idle money that can be saved each month without affecting the cost of living of individuals and families.

» Investing in DFVN-CAF, investors can invest a minimum of VND 1 million per month or per quarter.